The increasing need for Long-Term Care Insurance

Article Licenses: unknown

Advisor Licenses:

Compliant content provided by Adviceon® Media for educational purposes only.

The need for Long-Term Care Insurance is increasing as medical intervention and medications keep us living longer.

- Every year, about 50,000 strokes occur in Canada. A stroke is the leading cause of a transfer from hospital to a long-term care facility.

- Nearly 10% (1 in 11) of Canadians over age 65 are affected by Alzheimer’s disease or related dementia.

- An increasing demographic (7%) of Canadians age 65 and over are residing in healthcare institutions.

- An additional 28% of Canadians age 65 and over receive care for a long-term health problem, outside of a healthcare institution.

Sooner or later ageing baby boomers starting to enter retirement will increasingly depend on long-term care, offered by their children or professional health care services.

A study authored by Dr. Marcus Hollander and Neena Chappell of the University of Victoria found that approximately $25 billion dollars worth of unpaid care is provided willingly by family members and friends in lieu of paid care.

As the populace ages, more care for the elderly, such as respite care (additional home care services) will increasingly be needed to provide family members with the medical guidance and support they need to continue caring for their loved ones. With this in mind, are our families financially prepared to deal with costs associated with providing long-term care for loved ones?

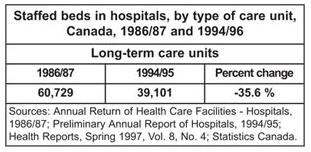

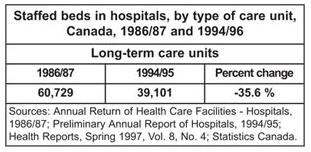

Fewer hospitals offer long-term care A historic study which remains relevant, looked at a trend which revealed a 35.6% reduction in staffed long-term care beds in the extended care sector, from the late-80s to mid-90s, when our ageing population has been growing at an unprecedented rate. The baby boomer population is noticeably ageing. Canadians need to concern themselves with this question: Will governments be able to provide the necessary spaces and accommodate the increasing demand on the healthcare sector with regard to long-term care?

Source: Statistics Canada, pre-baby boomer info

What does Long-term Care Insurance (LTC) offer? Long-term care insurance provides money to pay for the care that you both desire and need. With LTC Insurance, you have:

- Broader choices about the quality and amount of care you receive.

- An increase of choices when determining where you receive care and by whom.

Sources: Canadian Institute for Health Information, Alzheimer Society website, Statistics Canada

Source: Some of the concepts and information are used with the permission of Patty Randall who is widely considered a leading advocate on the need for care-years planning in our country. Visit her website: “Aging Successfully with Passion and Purpose and Care-Years Planning” online at www.longtermcarecanada.com for discussions, ideas and to obtain family materials on this issue.

Publisher's Copyright & Legal Use Disclaimer

All articles are a legal copyright of Adviceon®Media and are for educational

purposes only. The particulars contained herein were obtained from sources

which we believe are reliable, but are not guaranteed by us and may be

incomplete. This website is not deemed to be used as a solicitation in a

jurisdiction where this representative is not registered. This content is not

intended to provide specific personalized advice, including, without

limitation, investment, insurance, financial, legal, accounting or tax

advice; and any reference to facts and data provided are from various sources

believed to be reliable, but we cannot guarantee they are complete or

accurate; and it is intended primarily for Canadian residents only, and the

information contained herein is subject to change without notice.

References in this website to third party goods or services should not be

regarded as an endorsement, offer or solicitation of these or any goods or

services. Always consult an appropriate professional regarding your particular

circumstances before making any financial decision. The information provided

is general in nature and should not be relied upon as a substitute for advice

in any specific situation. The publisher does not guarantee the accuracy and

will not be held liable in any way for any error, or omission, or any

financial decision.

Life Insurance and Segregated Funds Disclaimer

Life Insurance policies vary according to contract terms. Please read any

Life Insurance policy contract provided, or the segregated fund summary

information folder prospectus before the time of purchase. Full details of

coverage, including limitations and exclusions that apply, are set out in

the policy of insurance. Commissions, trailing commissions, management fees

and expenses may be associated with segregated fund investments which may

not be guaranteed and their market value changes daily and past performance

is not indicative of future results. A description of the key features of a

life insurance policy, a segregated fund; and any applicable individual

variable annuity contract is contained in information provided by the

company from which it is purchased. Talk to your advisor before making any

financial decision. For specific situations, advice should be obtained from

the appropriate legal, accounting, tax or other professional advisors. The

information provided is accurate to the best of our knowledge as of the date

of publication and is general in nature, intended for educational purposes

only, and should not be relied upon as a substitute for advice in any

specific situation. For specific situations, advice should be obtained from

the appropriate legal, accounting, tax or other professional advisors.

Rules and their interpretation may change, affecting the accuracy of the

information.